Getting ahead while renting

Getting ahead while renting

It’s no secret that home ownership in Australia is on the decline - under 40s ownership has dropped over 10% in 15 years, from 36% in 2002 to 25% in 2017*.

For those who feel they have been locked out of the housing market, the high barriers of entry to home ownership at present can be overwhelming.

It’s not all bad news, but it does mean those thinking outside the box may have the upper hand. While renting can feel like you’re getting nowhere - one of the key benefits is that it can free up part of your income to invest.

Considering term deposit rates are at all-time lows, this is where investors need to be switched on to reach their financial goals.

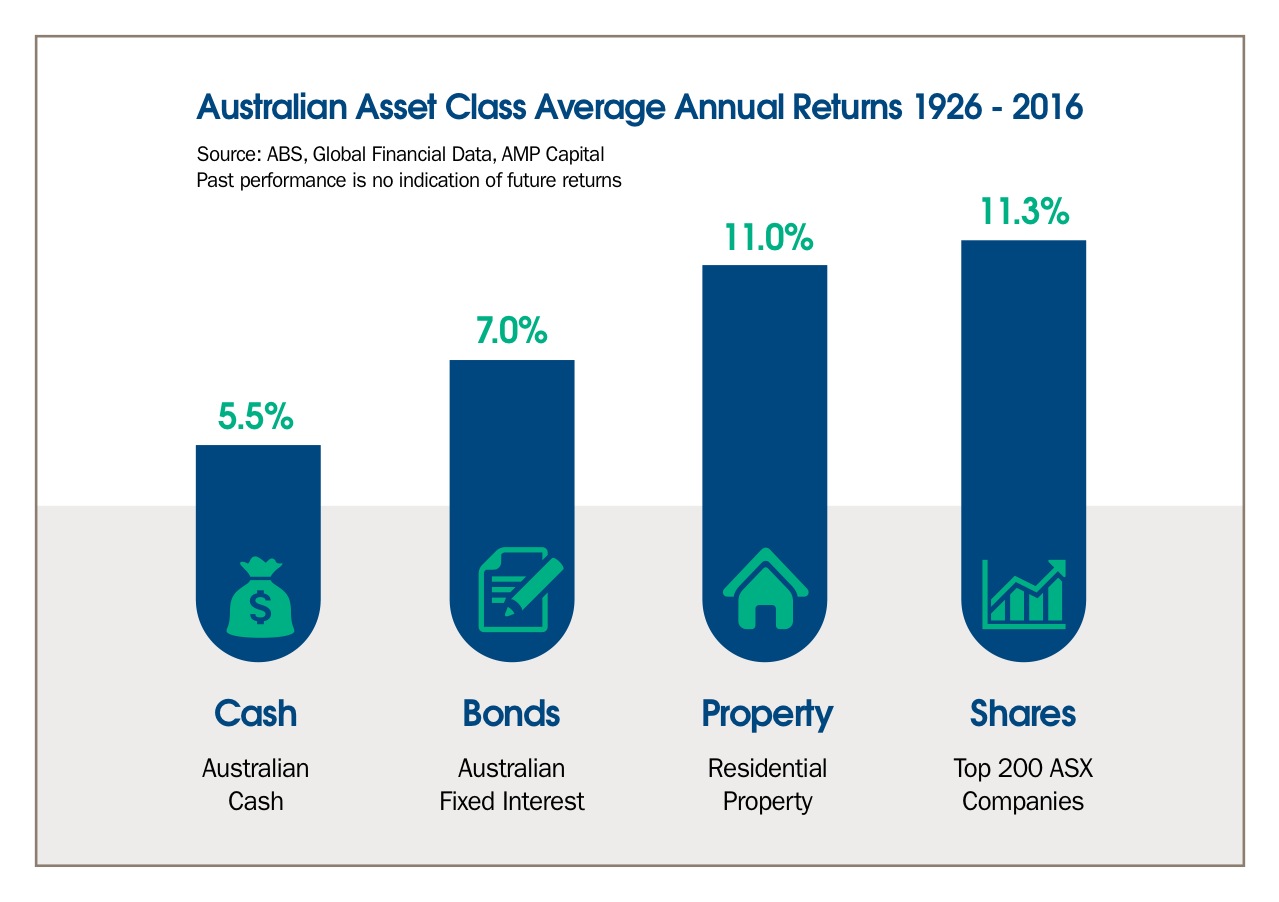

The answer may lie in the share market. While stock investing may have ups and downs in the short term, in the longer term it tends to see a similar return to property. This may mean shares are suitable for those with medium to long term investment timeframes.

When to start?

If you are unsure when to start investing in the share market then you should consider a regular gearing plan. Regular monthly investments means that you will buy more should the market fall or rise. This averages your market entry price and helps smooth out the effects of short term volatility - a strategy known as ‘dollar cost averaging’.

How does it work?

A regular gearing plan allows you to invest into the share market on a monthly basis. For every $1 invested, Leveraged will lend you $1. Investors using this strategy would usually invest into a diversified managed fund or exchange traded fund (ETF).

The key is to save surplus funds from renting, the same way you would if you had a mortgage. This way you may have enough set aside to reach those longer term financial goals such as a home deposit.

Like all investments, borrowing to buy financial products carries risk – gearing can magnify your gains, as well as your losses.

If you have any questions, or would like to discuss your loan account, please contact your Relationship Manager or call Leveraged on 1300 307 807.

*source HILDA and ABS

Gearing involves risk. It can magnify your returns, however it may also magnify your losses.

Leveraged Equities Limited (ABN 26 051 629 282 AFSL 360118) is a subsidiary of Bendigo and Adelaide Bank Limited (ABN 11 068 049 178 AFSL 237879).

Information is general advice only and doesn't take into account your personal objectives, financial situation, or needs. The views of the author may not represent the views of the broader Bendigo and Adelaide Bank Group of companies (“the Group”). This information must not be relied upon as a substitute for financial planning, legal, tax or other professional advice. You should consider whether or not the product is appropriate for you, read the relevant PDS and product guide available at www.leveraged.com.au, and consider seeking professional investment advice. Not suitable for a self-managed superannuation fund.

Examples are for illustration only and are not intended as recommendations and may not reflect actual outcomes. Past performance is not an indication of future performance. The information provided in this document has not been verified and may be subject to change. It is given in good faith and has been derived from sources believed to be accurate. Accordingly no representation or warranty, express or implied is made as to the fairness, accuracy, completeness or correction of the information and opinions contained in this article. To the maximum extent permitted by law, no entity in the Group, its agents or officers shall be liable for any loss or damage arising from the reliance upon, or use of the information contained in this article.