Expand your knowledge about gearing and its value in helping achieve your financial goals.

Use our tools and resources

Product comparison table

Use our product comparison table to educate yourself with our solutions.

Fact sheets

Use our fact sheets to educate yourself with our solutions.

Borrowing to invest

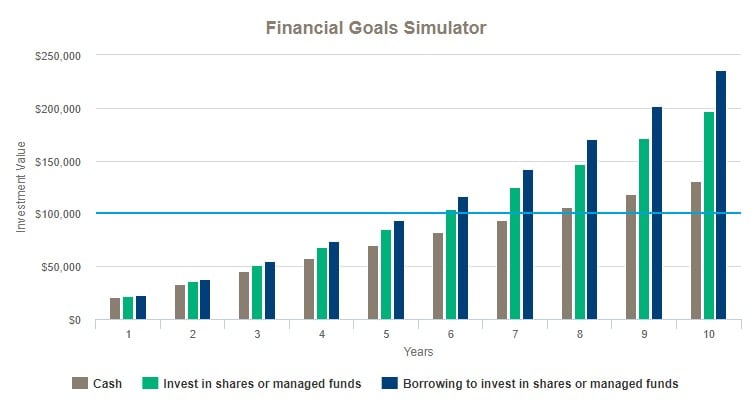

Borrowing to invest, or gearing, is a strategy used to purchase shares, managed funds, or other investments. This can increase your investment capacity to help you grow your investment portfolio. A gearing strategy can be used for a variety of reasons, including wealth creation.

Our financial goals simulator* can provide you an estimate of the investment value of your portfolio, with and without gearing, based on the information you provide. Use our simulator today to compare returns with or without gearing.

It’s important to understand both the benefits and risks of adding a gearing strategy to your portfolio. We recommend speaking to your financial adviser for advice.

Economic overview

Our monthly economic and market overview summarises the primary features of global markets. It covers the latest news and views on the domestic economy and interest rates. The report focuses on factors that will influence the economic environment in which local businesses operate.

Fact sheets

-

Leveraged Margin Loan Fact Sheetpdf, 100 KB

-

Leveraged Investment Funds Multiplier Fact Sheetpdf, 122 KB

-

Leveraged Direct Investment Loan Fact Sheetpdf, 96 KB

-

Leveraged Exchange Options Plus Fact Sheetpdf, 91 KB

-

Leveraged Instalment Plus Fact Sheetpdf, 141 KB

-

Leveraged Rewards Plus Fact Sheetpdf, 193 KB

-

Leveraged Covered Calls Fact Sheetpdf, 127 KB

Get in touch

Phone

1300 307 807

+61 2 8282 8282 (If calling from overseas)

8:30am - 5:30pm AEST/AEDT

Monday - Friday

Online

Send us an online enquiry or email customerservice@leveraged.com.au

GPO Box 5388,

Sydney, NSW, 2001

Things you should know

*The Financial Goals Simulator chart image is for illustrative purposes only and does not indicate any view of, or expectation about, any Leveraged margin loan product or any investment or transaction. It does not cover all the possible outcomes and is not intended as a recommendation. It is simplified and may not reflect actual outcomes, market prices or movements or taxation treatment.

Gearing involves risk. It can magnify your returns; however, it may also magnify your losses.

The Leveraged Equities Margin Loan, Investment Funds Multiplier and Direct Investment Loan are issued by Leveraged Equities Limited (ABN 26 051 629 282, AFSL 360118) as Lender and as a subsidiary of Bendigo and Adelaide Bank Limited (ABN 11 068 049 178, AFSL 237879). No warranty or guarantee is given by the Lender, any other party named on this website or any of their respective related bodies corporate for the performance of any investment acquired using money borrowed through the Margin Loan/Investment Funds Multiplier/ Direct Investment Loan or any investment on the list of Acceptable Investments. Any obligation of the Lender, Sponsor or Nominee or money held in a Loan Account are not deposits with or liabilities of Bendigo and Adelaide Bank Limited.

The information on this website contains general advice only and does not take into account your personal objectives, financial situation or needs. This information does not constitute financial or tax advice. We recommend that you obtain your own independent professional and tax advice on the risks and suitability of this type of investment and to determine whether your interest costs will in fact be fully deductible in the current financial year in your particular circumstance. Terms, conditions, fees, charges and normal lending criteria apply.

Please consider your personal circumstances, consult a professional financial adviser and read the Product Disclosure Statement and Incorporated Statements (together, the 'PDS') and Product Guide, together with the terms and conditions applying to the product or service, before making an investment decision. To obtain a copy of the PDS and relevant information please call 1300 307 807, visit the individual product pages on this website, or contact your financial adviser. Not available for a self-managed superannuation fund.